Income producing assets

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

When constructing a portfolio, investors who are seeking income have a range of options to choose from. Two of the most popular strategies pursued by income-seeking investors are a portfolio of individual bonds or a portfolio of dividend-paying stocks. While the dividend strategy has some advantages, such as the potential for equity price appreciation and outsized total return, it comes with the potential disadvantages that companies can simply choose to stop paying a dividend at any time and/or equity prices fall resulting in principal loss. For investors who need a steady and consistent income stream to live off of (or for any other reason), the reduction or elimination of a dividend could have negative effects. And of course, a loss of principal is never a desired outcome. One of the valuable characteristics that comes with owning a portfolio of individual bonds is that the income stream is locked in from the date of purchase. An issuer cannot simply choose to stop making the coupon payments on their bonds. Income, cash flow, and redemption value are known to the investor from day one.

In addition to the always-present characteristics that come with individual bonds mentioned above, for investors who are looking for income producing strategies in the current market, fixed income offers a very compelling case from both an absolute yield perspective as well as a relative value perspective. There are very few times over the past 15+ years that have offered a more attractive entry-point for a fixed income portfolio. Using the 10-year Treasury as a benchmark, the current yield of 5.52% is higher than it has been for 97.8% of the time since 2010. Turned around, on only 2.2% of the days over the past ~15 years has it been a more attractive time to lock in income.

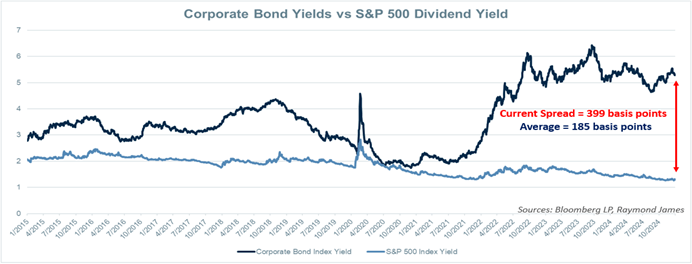

On the relative value front, comparing the dividend yield of equities to the yields available in corporate bonds offers a good benchmark for assessing the relative value between the two asset classes from an income perspective. To offer some perspective on this relationship, the above chart shows the dividend yield of the S&P 500 (light blue line) along with the yield of the Bloomberg Investment-Grade Corporate Bond Index (dark blue line) over the past 10 years.

The relative value available of corporate bonds is clear. The current corporate bond yield of 5.28% is 399 basis points higher than the dividend yield of the S&P 500, which is 1.29%. While comparing these yields on an apples-to-apples basis comes with a range of challenges, noting the current spread between the two and how that compares historically provides some useful context when comparing across asset classes. The average spread between these yields since 2015 is 185 basis points, which highlights just how attractive the 399 basis point spread we are currently seeing is from a historical perspective. For investors seeking income-producing investments, the always-present characteristics of individual bonds combined with both the relative value advantage and absolute yields offered make a compelling case. Contact your financial advisor today for ideas on how to take advantage of these current market opportunities.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.